正文

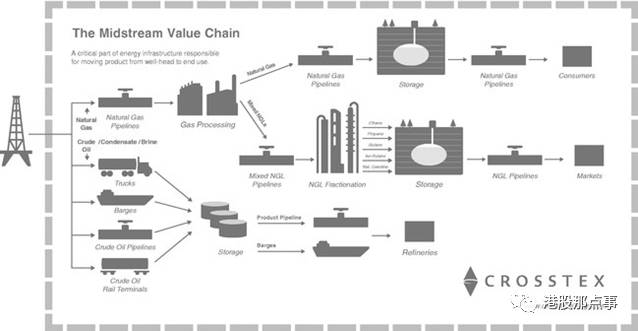

中游的MLPs企业是MLP中规模最大的那一个部分。正如名字所示,中游的公司处在上游开采原油和天然气的公司和下游分销产品的公司之间。中游企业主要负责管道、储存设施、以及/或者包括炼油厂。这些都是事先修建好的固定资产,主要为了生产特定的产品,以及提供某些固定方向的输送。它们像收过路费那样跟使用其设备的生产商收费。

With the advent of large scale horizontal drilling roughly 8 years ago and the surge in hydrocarbons flowing out of Alberta, the Bakken, DJ Basin, Marcellus, Permian, Eagle Ford, et al, the US experienced a huge build out of energy infrastructure. Much of this build out took place via MLPs.

八年前,随着大规模的水平钻井的出现,以及大量碳氢化合物从阿尔伯塔省、贝肯、丹佛朱尔斯堡盆地、马尔瑟吕、伊格尔、福特等地冒出来,美国由此进行了大量的能源基础设施建设。大量建设都是MLPs企业完成的。

Attractive Features of Midstream MLPs

中游MLPs企业吸引人的特征

Our look at Midstream MLPs focused specifically on companies providing oil storage services. The MLPs that derive 90% to 100% of their revenue from oil storage fees are;

在中游MLPs企业里,我们着重研究提供石油仓储的企业。石油储藏费用占了90%到100%总营收的MLPs企业有:

1.Arc Logistics (ARCX)

2.PBF Logistics (PBFX)

3.VTTI

4.West Point Terminals (WPT)

These companies have many of the characteristics we look for:

这些公司身上有很多我们看重的特征:

•

Stable and Predictable Cash Flows – A number of mechanisms provide a substantial degree of security around future cash flows:

•

稳定、可预测的现金流 —— 特定的运行机制为未来可持续的现金流提供了保障。

Limited Commodity Price Exposure – Although the MLPs operate in a highly cyclical industry, they are relatively insulated from the cycles because they do not take ownership of the oil at the terminals.

有限的商品价格风险— 虽然这些MLPs公司处在高度周期性企业,但是它们几乎是跟周期绝缘的,因为并不在终端拥有石油产品。

Volume Security – Many oil storage contracts contain minimum volume commitments (MVCs)

保量交易—很多石油储蓄合同会签订储存最少量。

Long Term contracts – Typically contracts have two 5-year renewal terms and inflation-based cost escalators.

长期合同—通常会签订两个5年的续约条款,并且设置基于通货膨胀的指数调解条目。

Customer Stickiness – Customers tend to stick around for a long time. The top ten customers for one storage MLP, World Point Terminals (WPT) have been with them for average of 9+ years

客户粘性—客户倾向于有较长时间的粘性。世界终端(WPT)运输MLP公司前10名客户平均跟其合作了9年之久。。

•

High barriers to entry, including:

•

高市场壁垒,包括:

Limited locations that possess the requisite characteristics necessary to support an oil storage business, such as proximity to pipelines, refineries, processing plants, waterway, demand markets and export hubs;

只有少数地点具备支撑石油仓储的必须条件,如像石油管道、炼油厂、石油加工厂、航道,这些需要市场以及出口港。

the extended length of time and risk involved in permitting and developing new projects and placing them into service, which can extend over a multi-year period depending on the type of facility, location, permitting and environmental issues and other factors;

新项目从获得准许到开展、并投入使用,需要很长的时间,并伴随着大量风险。取决于具体设施、地点、准许情况、环境问题和其它一些问题,有的甚至长达数年。

the magnitude and uncertainty of capital costs, length of the permitting and development cycle and scheduling uncertainties associated with terminal development projects present significant project financing challenges, which could be exacerbated by any tightening of the global credit markets; andthe specialized expertise required to acquire, develop and operate storage facilities, which makes it difficult to hire and retain qualified management and operational teams.

资金成本的需求量和不确定性、获得准许和建设周期的长短、以及终端项目开发计划的不确定性,代表着巨大的项目财务挑战。这一挑战会由于全球信贷市场的紧缩而加剧。并购、开发、运营储存设施所需的专业技能使得雇佣合格的管理运作团队十分艰难。

•

Easy to Understand – Even we can understand owning a big tank and being paid to store someone’s oil in it.

•

容易理解—一个大的储存仓,向储存石油的人收费,这个我们都懂。

Conventional wisdom suggests midstream MLPs are generally the most stable assets within the MLP landscape.

人们普遍的看法是中游MLPs企业总体而言是所有MLP企业中资产最稳定的。

General Organization Structure of MLPs

MLPs企业一般的组织结构

Unfortunately, the conventional wisdom is wrong. Wall Street took these straightforward boring businesses and put them in highly engineered structures. See below: