正文

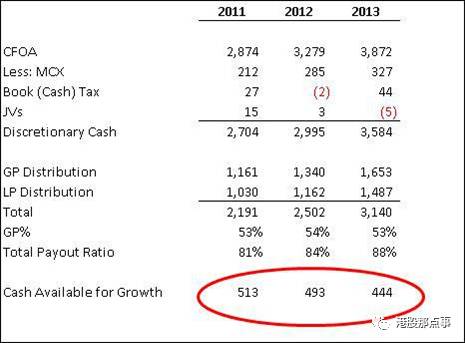

在2011年时,金德摩根的MLP公司,也即金德摩根合伙公司,就处于高分位点。普通合伙人所得分红高于单位信托合伙人所得分红的50%。再者,公司当时不需要用上的现金几乎100%被分配掉了。这样一来给投资增长留下来的钱还剩多少呢?必然所剩无几。

CashFlows, 2011-2013

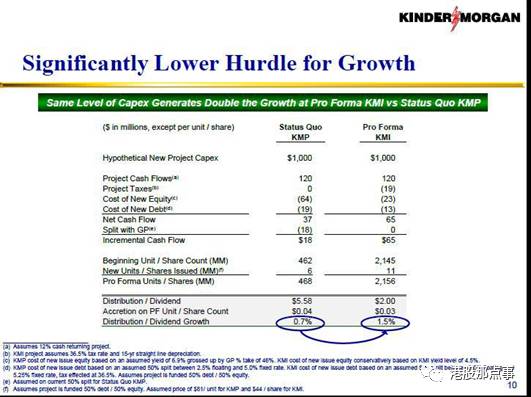

Further, with the GP in the high splits, theMLPs cost of capital was enormous and the corresponding hurdle rate for newinvestments severely limited the universe of accretive investments. Hereis a slide from a Kinder Morgan investor presentation showing the return tominority unitholders and shareholders from a new investment in the MLPstructure and in the more traditional corporate structure:

再者,当普通投资者分红较多时,MLP企业的资本成本很高昂,对应的新投资项目的要求回报率限制了累计投资。如下所示,金德摩根投资者关系展示PPT分别展示了在MLP模式里和更为传统的公司里少数单位信托证券持有者及股东得到的回报。

Kinder Morgan opted to hop off the MLPTreadmill rather than extend the pain. In 2014, they rolled up their MLPsinto the Sponsor, effectively reversing years of drop downs.

金德摩根选择跳下MLP跑步机结束痛苦。2014年时,他们把MLP企业还给了赞助商,从而有效地扭亏为盈。

Conflicts of Interest

利益冲突

When we take a minority position inpublically traded companies, we always face the risk that the business is beingrun for the benefit of the majority owner and to the detriment of minorityowners. However, this risk is dramatically heightened if none of thetraditional protections for minority ownership are in place. Such is thecase with MLPs

一旦我们持有少量上市公司的股份,我们会经常面临公司损耗小股东利益为大股东谋利的情况。一旦小股东没有传统保护措施,这种风险会严重加强。MLP企业就如此。

a. Fiduciary Duty Waived

受托责任免除

As discussed above, MLPs are organized aslimited partnerships rather than the more common corporation. MLPs takefull advantage of the fact that Delaware law does not require GPs to act in the best interests of the LP. Therefore, as shocking as this sounds, the GPmay act free of any duty or obligation to the MLP or its limited partners.

正如之前论述的,MLP企业采取的是有限责任合伙制,这跟普通的公司制不一样。MLP企业很好地利用了特拉华公司法不要求普通合伙人为有限合伙人的利益服务的规定。因此,即便听起来很耸人听闻,普通合伙人对MLP公司、或者是有限合伙人根本不需要承担任何责任或义务。

b. IDRs Mean That Deals Can Be Accretive To The GP And Not The LP

IDR(激励分配权利)意味着普通合伙人可享受交易的增值性,但是有限合伙人享受不到。

The way IDRs are calculated makes itpossible for actions to be taken that are accretive to the GP but notnecessarily to existing LPs. Distributions paid to the GP are not based on thedistribution per LP unit but the gross distribution to LPs. Therefore,even if the distribution per unit remains the same, the GP will receive agreater distribution. Here is a simplified example:

IDR获得的方式让普通投资者得以采取行动获得增值回报,但是对现有的有限投资者来说并非如此。普通合伙人获得的分红并非基于有限合伙人获得的分红,而是基于所有有限合伙人的总分红所得。因此,即使每个单位分红额度一样,普通合伙人还是能拿到更多的分红。有个简单的例子:

Notice that the equity funded acquisition,results in a 10% increase in the distribution to the GP while the LP remainsthe same.

比如股权出资收购会使普通合伙人的分红增加,而有限合伙人的保持不变。

c. Drop Downs Are Not At Arms-Length

下跌并非公平的

Drop downs are often touted as a benefit ofMLPs. For example, the amount of assets available for drop down by theSponsor is used as a rough proxy for the future growth of the MLP. But,drop downs create a terrible conflict of interest. How can aminority owner of the MLP have any assurance that both parties are negotiatinga fair deal?

股价下跌往往被吹捧成是MLP企业所受的益处。比如,赞助者提供的支撑下跌的资产往往被当作促进MLP企业未来增长的大致替代品。但是下跌造成了非常严重的利益冲突。MLP企业的小股东如何能保证双方能协商出一个公平的交易呢。

d. Lack of Voting Rights

没有投票权

Unlike common shareholders, MLP LPs haveseverely restricted voting rights and no vote for the board of directors.

跟普通股东不同,MLP有限合伙人的投票权严重被限制,董事会根本没有投票权。

Other Ways Management Can Rip You Off

管理层欺骗你的其它的方式

Management has several other ways it can ripoff the minority owners

管理层也能通过其它一些方法欺骗小股东.

1. Accounting Games

财务游戏

The most straightforward method managementhas to rip off investors is playing games with the numbers. As statedearlier, MLPs are required to distribute all available cash. However, allavailable cash is not a term defined under GAAP. This gives managementsignificant leeway to pump up the numbers.

管理层欺骗投资者的最直接的办法就是拿数字做文章。正如我们早先所说,MLP企业必须把所有的可支配现金分配出去。但是所有可支配现金并非GAAP会计准则下有明确定义的一个条款。这就给了管理层很多机会去拿数字做文章。

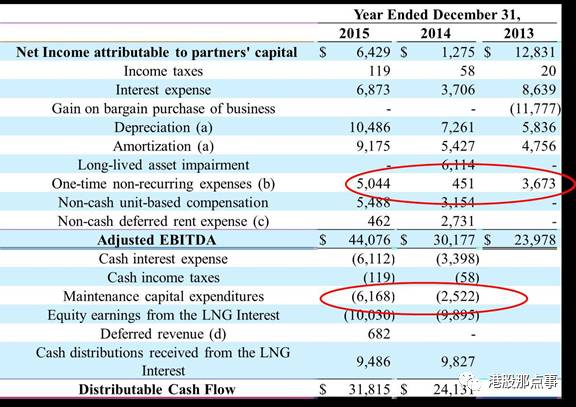

Below is a typical calculation of distributablecash flow by an MLP.

下面是一家MLP公司典型的计算可自由支配现金的方式。

Source: ARCX 10-K

A couple of items stick out. First,the “one-time non-recurring” expenses sure do seem to recur a lot. Buteven more importantly, they are true expenses and a reduction to cash. Why are they being added back?

有几个条款很醒目。首先是“一次性非经常性”开销确实经常出现。但更重要的是它们都是实打实的花销,是对现金的消耗,为什么又被加了回来?

Second, “maintenance capital expenditures”is not a term defined under GAAP. This gives management a lot of leewayto play around with the numbers. Per the 10-K, management simply definesmaintenance capital expenditures as “(i) clean, inspect and repair storagetanks; (ii) clean and paint tank exteriors; (iii) inspect and upgradevapor recovery/combustion units; (iv) upgrade fire protection systems;(v) evaluate certain facilities regulatory programs; (vi) inspect andrepair cathodic protection systems; (vii) inspect and repair tankinfrastructure; and (viii) make other general facility repairs asrequired.” This last point is vague enough to cover (in good years) ornot cover (in bad years) just about any capital expenditure.

第二,“维护资本支出”也并非GAAP会计准则里有确切定义的项。这给管理层很大空间玩弄数字游戏。每一份年报中,管理层都单纯地对维护资本开支给出这样的定义:“(i)清洁、检查、修理储罐;(ii)清洁和粉刷罐表面;(iii)检查升级蒸汽回收和燃机组;(iv)升级火力保护系统;(vi) 检查和修复阴极保护系统;(vii)检查和修复储存设施;(viii)按要求修复其它设施。”最后的模糊项足够覆盖掉(在收益不错的年份里)任何资本开支,或者不包含(在收益差的年份里)这些资本开支。

Maintenance Capex, however, is intended torepresent the cost inherent in maintaining the Company’s current capacity, andis generally funded from operating revenues. Because of that, expendituresclassified as Maintenance Capex reduce the funds that may be distributed to thegeneral partner and the unitholders. The GP has a powerful incentive toclassify whatever expenses possible as Expansion Capex, as that leads to alarger payment for the GP.

但是维修预算本该是维护公司现有运作能力的开支,它应该来自于运营收入。因此,被归作维修预算的成本应该减去本该分配给普通合伙人和单位信托证券持有人的现金。普通合伙人有强大的动机将一切花销都尽可能归类为维修预算,这样以来分给普通合伙人的利润会更高。