正文

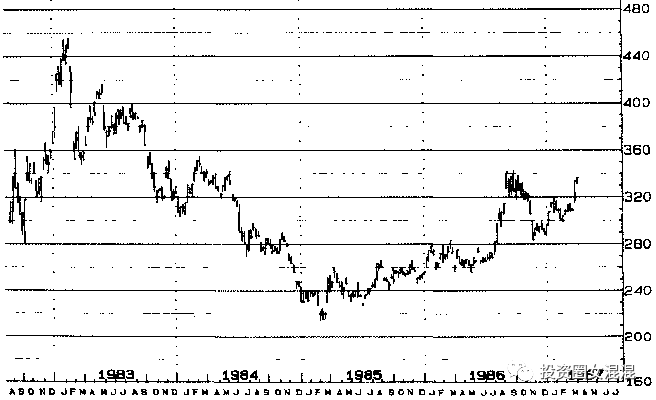

【1984

was a year of confusion and ambivalence for the futures trader. The

news and recommendations were almost universally bullish, and

speculators bought into the first quarter rally on the assumption that

prices were starting to head north. In reality, this brief advance was

just a minor pause in the major bear trend that had gripped futures

market since 1983 and would continue through 1985-86. Only the

disciplined and pragmatic technical traders made money-and lots of it-on

the short side of these markets.

1984年对期货交易者而言是让人头昏的一年。新闻报导和投资建议几乎全面偏多。春季价格反弹,投机者以为价格开始上涨,开始买入。其实,短暂的上升趋势只是主要空头市场的喘息期,原来期货市场从1983年便步入空头,并延续到1985——86年。只有守纪律且务实的交易者在期货市场做空才能赚钱,而且是大钱。】

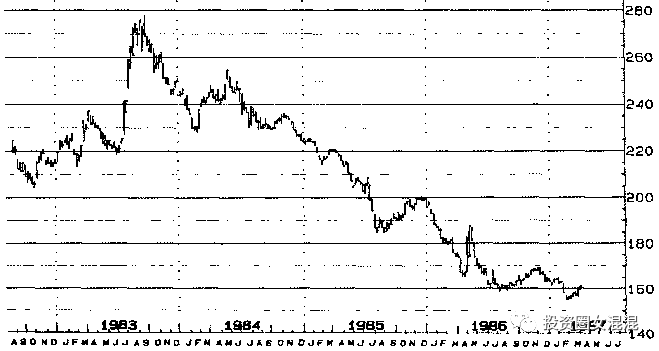

图6-2B 贵金属指数

Digesting

such a steady diet of bullish news couldn’t fail to give one a bullish

bias-but an objective and pragmatic reading of the various technical

factors showed clearly that we were in a bearish, or at best a

sideways-to-down situation.

Successful

speculators, with a disciplined and pragmatic approach to their trend

analysis and utilizing a viable trend-following strategy, would have

ignored all that pap and focused instead on a sound technical analysis.

By

so doing, they would have either scored some profits on the short side

or, at least, been kept away from the long side and its attendant red

ink.

听了这些源源不断的利好消息,人们不做多也难,不过,如果客观和务实地研读各种技术因素,我们可以很清楚地看出这个市场走的是空头市场,至少是比较弱的局面。

成功的投机者既严守纪律,又用很务实的方法分析趋势,并采用可行的顺势交易策略,对于这些杂音,根本听而不见,而只是一心一意钻研技术分析。

这么做,一方面可以因做空而赚到一点钱,另一方面,又可不必因做多而亏钱。

The

frequent divergence between what you read in your charts and system

printouts and what you read in the printed word or hear on TV seems to

provide a near-permanent feeling of ambivalence to most speculators. And

this applies to projections of general conditions as well. Half of our

learned economists keep telling us that, if interest rates advance, we

will have a general bear market in commodity prices because higher

interest rates increase the cost of carrying inventory and encourage

trade firms to reduce and defer purchase of inventories. Also, with

higher interest rates, investors tend to put funds into higher-yielding

credit instruments rather than in risky futures positions. There surely

is logic in that argument. The rub though is that the other half of our

economists tells us that if interest rates decline, we will have a

general bear market because it would signify an overall reduction in

inflation, meaning falling commodity values; and besides, investors

wouldn’t look to buy commodities as an inflation hedge when they see

reduced inflation ahead.