正文

Relative to the high level of domestic savings, domestic supply of investment products in the Mainland has been inadequate to meet investment demand of Mainland residents for asset value preservation and appreciation. This leads to the situation of asset shortages in Mainland China since 1990 as documented by an academic study, and the consequential phenomenon of asset bubbles, exemplified by price surge in the property market, stock market and even consumer goods. The study explains that asset shortage is measured by the excess in percentage of domestic savings (i.e. the asset demand) relative to the asset supply which is constituted by domestic bonds, shares, loans, change in short-term deposits and net purchase of foreign assets. As a point of reference, the total funds raised by equity issues on the SSE and the SZSE in 2015 was about RMB 1,540 billion, which was less than 5% of the domestic savings as at the end of 2015 ― similar to the 5% level for total overseas securities investment in 2015 (see Figure 14).

Global asset allocation has therefore become an imminent need of Mainland investors. Moreover, there is a need for more income from overseas investments to improve China’s national balance sheet. While the One-Belt-One-Road (OBOR) strategy would promote income from ODI by investing in the developing countries, increasing overseas portfolio investment could offer potentially significant income.

Currently, apart from Southbound trading under Stock Connect, the QDII scheme is the only legitimate channel for overseas securities investment. However, this is subject to quota limit and approval. As a matter of fact, there has been no increase in QDII investment quota since March 2015, which remained at US$89,993 million by June 2017 (see Figure 16). This was less than 2% of the domestic savings as of end-2015.

Besides QDII, there is known to be a “green channel” offered by SAFE under which special authorisation is obtained from SAFE for certain domestic investors (mainly Mainland cornerstone investors) to subscribe for IPO shares offered by Mainland enterprises to be listed in Hong Kong. This practice started from the IPO of the Postal Savings Bank of China Co., Ltd and has been applied to IPOs of several Mainland enterprises since then. However, this is a special practice under special authorisation applied to special enterprises and is subject to special requirements imposed by SAFE.

Southbound PEC would open up one more official global asset allocation channel for Mainland investors, possibly in a wider scale than existing channels, by enabling them to subscribe new shares of international companies to be listed in Hong Kong. This would enhance the overseas portfolio investment of Mainland capital to a larger degree than the current only way of secondary market connectivity.

(2) Facilitating two-way market opening

In an attempt to open up the Mainland domestic market for fund raising by international companies, the success factors would lie in the attractiveness of the Mainland market to potential issuers on the considerations of funding needs and the cost of capital. Some big international companies seeking business expansion in China may be interested due to the branding effect offered by a domestic listing status. Nevertheless, there may not be many of these companies to provide a continuous supply of issuers. As the regulatory framework of the Mainland stock market is very different from that of international developed markets, potentially high compliance costs may deter the majority of potential foreign issuers to list in China, even if an international board is available in the domestic market.

In comparison, with PEC under the Mainland-Hong Kong Mutual Market model, foreign issuers would abide by the more familiar, internationalised rules and standards of the Hong Kong stock market for share offerings to the Mainland investors. As illustrated in Figure 17 below, the connectivity platform of the Mutual Market34 enables Mainland domestic capital and financial products to go out and international capital and financial products to go into China, without the need for investors and issuers on either side of the Mutual Market to adapt to practices on the other side.

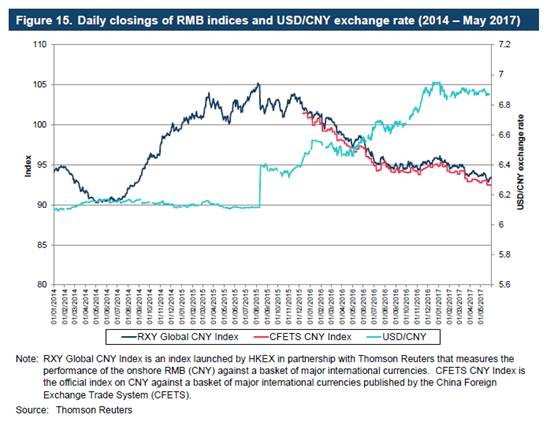

(3) One more step in RMB capital account convertibility

Southbound PEC under the Mutual Market would effectively implement RMB convertibility in one more item under the capital account, i.e. the offering of shares or equity-type securities by non-residents to the Mainland domestic investors. In the future, other suitable connectivity initiatives (e.g. the offering of financial derivatives) could be introduced under the Mutual Market model for achieving RMB convertibility under the remaining capital account items.

Although in the long run China could achieve comprehensive RMB convertibility under the capital account by some other means, PEC and other connectivity initiatives under the Mutual Market model could help speed up the process in a controlled manner (see point (7) below).

(4) Development of international investor base

As noted in Section 2.1 above, foreign holding in the Mainland stock market was less than 0.3% of the total negotiable market capitalisation on the SSE and SZSE, compared to 40% of foreign investor trading in the Hong Kong stock market. Northbound PEC would provide more opportunities to the Mainland for developing the international investor base in the domestic market, which is vital to achieving its stock market internationalisation.

IPOs with share offerings through Northbound PEC would be open to all international investors. Compared to domestic IPOs that are open only to qualified foreign investors (QFIIs and RQFIIs), IPOs under Northbound PEC are expected to involve more international marketing efforts from the issuers and the securities industry (both Mainland and international). International investors would be provided with intensive issuer information for their better understanding of the investment value, possibly in a more comprehensive way than domestic offers that focus on domestic investors. Moreover, relatively large holdings by foreign investors in Mainland shares could be achieved in the primary market through PEC without the share price impact as it would have for buying large block of shares in the secondary market.