正文

1.1 Secondary market connectivity ― Stock Connect

The Mainland-Hong Kong Mutual Market Access pilot programme (the “Pilot Programme”) waslaunched on 17 November 2014, initially with the commencement of the Shanghai-Hong Kong Stock Connect (Shanghai Connect), allowing cross-border stock investments in the Mainland and Hong Kong markets. The Shenzhen-Hong Kong Stock Connect (Shenzhen Connect) was subsequently launched on 5 December 2016. The (initially applied) aggregate quota for the Pilot Programme was abolished immediately upon the official announcement of the Shenzhen Connect on 16 August 2016. (Hereinafter, the Shanghai Connect and Shenzhen Connect are collectively referred to as the “Stock Connect scheme”.) By then, a Mutual Market platform across Shanghai, Shenzhen and Hong Kong was basically formed. This potentially opens up a Mainland-Hong Kong mutual stock market of a combined equity market value of US$10,514 billion (as of end-2016) and an average daily equity turnover of about US$84.3 billion (2016), ranking 2nd by market value (following New York Stock Exchange) and 2nd by equity market turnover among world exchanges. Moreover, the “Mutual Market” model may go beyond equities as eligible trading instruments, including exchange-traded funds (ETFs).

The Stock Connect scheme enables Hong Kong and overseas investors to trade securities listed on the Shanghai Stock Exchange (SSE) or Shenzhen Stock Exchange (SZSE) in the Mainland market (Shanghai (SH) or Shenzhen (SZ) Northbound Trading respectively under Shanghai Connect and Shenzhen Connect) and Mainland investors to trade securities listed on the Stock Exchange of Hong Kong (SEHK) in the Hong Kong market (SH or SZ Southbound Trading respectively under Shanghai Connect and Shenzhen Connect), within the eligible scope of the programme.

Eligible securities in SH Northbound Trading comprise SSE-listed constituent stocks of the SSE 180 Index and SSE 380 Index and otherwise the A shares which have corresponding H shares listed on SEHK, except those which are not traded in Renminbi (RMB) and those under risk alert. Eligible securities in SZ Northbound Trading comprise all SZSE-listed constituent stocks of the SZSE Component Index (SZCI) and of the SZSE Small/Mid Cap Innovation Index (SZII) which have a market capitalisation of RMB 6 billion or above, and otherwise all SZSE-listed A shares of companies which have corresponding H shares listed on SEHK, except those which are not traded in RMB and those under risk alert by SZSE. Eligible securities in SH Southbound Trading comprise SEHK Main Board-listed constituent stocks of the Hang Seng Composite LargeCap Index (HSLI) and the Hang Seng Composite MidCap Index (HSMI), or otherwise H shares which have corresponding A shares listed on the SSE, except those which are not traded in Hong Kong dollars (HKD) and H shares which have the corresponding A shares put under risk alert. On top of these, eligible securities in SZ Southbound Trading also include all the constituent stocks of the Hang Seng Composite SmallCap Index (HSSI) which have a market capitalisation of HK$5 billion or above, and all SEHK-listed H shares of companies which have corresponding A shares listed on the SZSE, except those which are not traded in Hong Kong dollars (HKD) and H shares which have the corresponding A shares put under risk alert.

As of 28 June 2017, there were 574 eligible (for both buy and sell) Northbound stocks and 310 eligible Southbound stocks under Shanghai Connect; and 901 eligible (for both buy and sell) Northbound stocks and 418 eligible Southbound stocks under Shenzhen Connect. In other words, around 44% and 45% in number of listed A shares respectively on the SSE and SZSE, and around 24% that on SEHK Main Board are Stock Connect eligible securities. By the end of 2016, the average daily Northbound trading value constituted about 2% of the Mainland Ashare market total turnover and the average daily Southbound trading value constituted about 8% of the SEHK Main Board total turnover.

1.2 Primary market opportunities

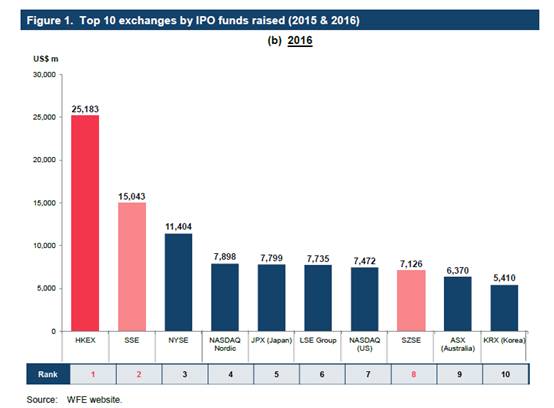

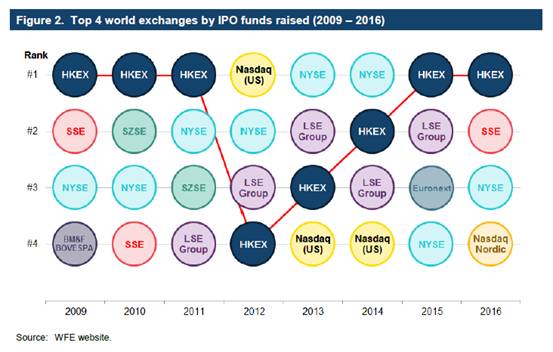

The Stock Connect scheme is an unprecedented mechanism that connects the Mainland stock market with an overseas market. However, currently this is confined to secondary equity market trading only and investors on either side of the border are barred from the primary equity market on the other side. This has deprived investors of the investment opportunities offered by initial public offers (IPO) of newly listed companies in the market across the border. According to the statistics of the World Federation of Exchanges (WFE), Hong Kong, Shanghai and Shenzhen were among the top ten markets by IPO funds raised in the past two years (see Figure 1). Hong Kong itself ranked first by IPO funds raised in 5 out of the past 8 years (see Figure 2).

In respect of the equity market, the Mainland-Hong Kong mutual market established through secondary market connectivity under Stock Connect is incomplete without primary market connectivity. In fact, the absence of primary market connectivity may harm investor interests under secondary market connectivity and bring about market unfairness. The recent case of the spin-off of BOCOM International Holdings Company Limited (BOCOM International) by Bank of Communications Co., Ltd (BOCOM Bank) was an example. BOCOM Bank has its H shares listed in Hong Kong and its A shares listed on the SSE. BOCOM Bank announced its proposed spin-off and listing of BOCOM International on the SEHK in August 2016. BOCOM Bank would provide its existing shareholders with an assured entitlement to the new shares in BOCOM International. However, due to the impediments arising from legal and policy perspectives, BOCOM Bank could only provide the assured entitlement to its existing H-share shareholders but not to its existing A-share shareholders. As advocated by market participants, the introduction of primary market connectivity would help resolve this kind of market unfairness.

In its Strategic Plan 2016-2018, HKEX put forward the Primary Equity Connect (PEC) together with Shenzhen Connect, as initiatives to further expand the mutual market connectivity. After implementation of Shenzhen Connect in December 2016, the PEC initiative is expected to further open up opportunities for Mainland investors’ global asset allocation. It will also support the further internationalisation of the Mainland stock market and help complete the connectivity mechanism, thereby enabling the pooling of liquidity in the Mutual Market to fulfil its function in fund raising by issuers and stock trading by investors. In a broader sense, the Mutual Market with PEC and possibly other connectivity initiatives could assist China’s bigger roadmap in economic development and RMB internationalisation. These are elaborated in sections below.

2. BOTTLENECKS IN MAINLAND AND HONG KONG STOCK MARKET DEVELOPMENT

Further market opening and internationalisation have been key policy directions of the Mainland capital market development. The 13th Five-Year Plan on Economic and Social Development (2016-2020) outlines the initiative of constructing a new pattern of all-round opening, which includes expanding two-way financial industry opening and capital market opening. In particular, it has been the central policy to develop Shanghai into an international financial centre (IFC). For this, initiatives were raised in a plan issued in 2015 by the People’s Bank of China (PBOC) jointly with other government departments to speed up the development of the Shanghai IFC. In March 2017, the State Council further issued a plan with financial reform and market opening initiatives in the China (Shanghai) Pilot Free Trade Zone (Shanghai FTZ). These include further deepening innovative opening and orderly progress in pilot schemes on capital account opening and internationalisation of financial practices in the zone.